Ethereum Price Prediction: Can ETH Reach $5,000 Amid Institutional Accumulation and Technical Breakout?

#ETH

- Technical Strength: Price holding above crucial moving averages with Bollinger Band expansion signaling volatility breakout potential

- Institutional Demand: Contrasting signals between ETF flows and treasury accumulations creating complex supply dynamics

- Sentiment Drivers: NFT market recovery and developer activity providing fundamental support despite macroeconomic concerns

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

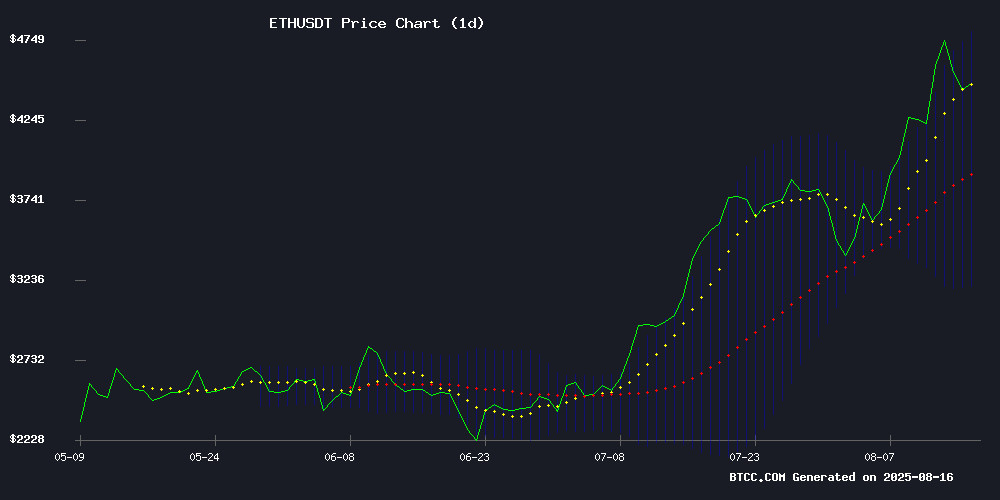

ETH is currently trading at $4,425.72, comfortably above its 20-day moving average of $3,995.12, indicating a bullish medium-term trend. The MACD histogram shows bearish momentum (-152.14), but narrowing divergence suggests weakening downward pressure. Bollinger Bands reveal price hovering NEAR the upper band (4,794.24), signaling strong buying interest though approaching overbought territory.

"The $4,000 psychological level has become strong support," says BTCC analyst Michael. "With the middle Bollinger band aligning with the 20MA, we're seeing textbook bullish structure. A sustained break above $4,500 could trigger momentum toward $5,000."

Mixed Market Sentiment as Institutional Accumulation Offsets ETF Outflows

Recent headlines paint a complex picture for Ethereum. While BitMine's $130M accumulation and SharpLink's treasury expansion to 728,804 ETH demonstrate institutional confidence, $59M in ETF outflows and Vitalik Buterin's risk warnings create headwinds.

"The institutional narrative remains intact," notes BTCC's Michael. "Market makers are clearly buying this dip - the $103M quarterly loss news WOULD typically cause sharper declines. The $5,000 target depends on whether spot ETH products can reverse their outflow trend."

Factors Influencing ETH's Price

Ethereum Dips Below $4.5K Amid SharpLink's $103M Quarterly Loss

Ethereum's price retreated to $4,391, marking a 3.8% decline over 24 hours after failing to breach the $4,700 resistance. The pullback triggered $169 million in futures liquidations, predominantly affecting long positions as bullish momentum waned.

Technical indicators signal short-term exhaustion, with the RSI and Stochastic Oscillator retreating from overbought levels. Critical support lies at $4,100, while a breakdown could test the $3,500 zone. Market participants anticipate consolidation before the next decisive move.

SharpLink Gaming's paradoxical financials added pressure—its Ethereum treasury ballooned to 728,000 ETH ($3.2B) while reporting a $103M quarterly loss. The firm has generated 1,326 ETH through staking since pivoting to crypto treasury management in May.

BitMine Expands Ethereum Holdings Amid Market Downturn

BitMine has acquired an additional 28,650 ETH during the recent market dip, bolstering its total Ethereum holdings to 1.174 million. The transaction was executed via over-the-counter addresses before transferring to BitMine’s WalletSimple storage system, underscoring the firm’s commitment to secure large-scale asset management.

Institutional confidence in Ethereum remains unshaken despite broader market weakness. Tom Lee, a prominent crypto analyst, is reportedly guiding BitMine’s accumulation strategy, mirroring institutional behavior seen in both traditional and crypto markets. On-chain data reveals similar patterns among whales, who continue to increase their Ethereum positions even as short-term traders anticipate further declines.

Ethereum whale activity has surged, with notable transactions signaling strong accumulation trends. This institutional demand could reinforce Ethereum’s long-term value proposition, contrasting with the current bearish sentiment among retail traders.

Ethereum Eyes $5,000 After Bitmine's $130 Million Accumulation

Institutional interest in Ethereum surges as Bitmine adds $130 million to its holdings, bringing its total ETH stash to $5.26 billion. The move signals growing confidence among large-scale investors despite recent market volatility.

ETH currently trades at $4,422, testing critical support levels after a 4.38% pullback. Analysts identify $4,402 as immediate support, with resistance looming at $4,790. A decisive breakout could propel the asset toward the psychologically significant $5,000 threshold.

Derivatives data reveals cooling momentum, with declining trading volume and open interest suggesting tempered short-term speculation. Market participants await either confirmation of support or a breakout above resistance for directional clarity.

Moonbirds NFTs Stage Remarkable Comeback After Acquisition by Orange Cap Games

Once written off as a cautionary tale in the NFT space, Moonbirds has dramatically reversed its fortunes following its acquisition by gaming studio Orange Cap Games. The Ethereum-based PFP project, which saw its floor price plummet from double-digit ETH values to under 1 ETH amid community backlash, has reignited market interest with a 97% recovery from its all-time low.

The May 2023 acquisition by Spencer Gordon-Sand's studio injected new life into the collection, positioning Moonbirds as a core IP for future development. "Moonbirds is my favorite IP in crypto," stated Spencer, highlighting his prior bullish stance on the project's Mythics artwork. The strategic move has transformed the once-mocked NFTs into one of crypto's most discussed collections.

Ethereum ETFs See $59M Outflows as ETH Retreats from Near Record Highs

U.S. spot Ethereum ETFs recorded net outflows of $59.34 million on August 15, snapping an eight-day inflow streak that had brought $3.7 billion into the products. The reversal coincided with Ethereum's pullback from $4,788—just 3% shy of its all-time high—to current levels around $4,450.

BlackRock's ETHA stood alone with $338 million in inflows, while Grayscale's ETHE led withdrawals at $101.74 million. Fidelity's FETH shed $272.23 million despite maintaining $2.74 billion in cumulative inflows since launch. The ETF flows mirror Ethereum's price action, with the recent rally to near-record levels having attracted $12.67 billion in total institutional inflows.

VanEck's ETHV and Franklin's EZET saw zero flows, while smaller ETFs posted mixed results. BlackRock's ETHA remains the category leader with $12.16 billion accumulated since launch.

Ethereum Price Targets $8,500 Amid Record ETF Inflows

Ethereum's market momentum surged in August as spot ETF inflows topped $729 million, pushing total monthly inflows beyond $3 billion. The ETH price hovered near $4,415 at press time, with analysts projecting a bullish trajectory toward $8,500.

Institutional demand fueled the rally, with daily ETF inflows regularly hitting hundreds of millions and peaking above $1 billion on strong trading days. Net assets in Ether ETFs reached record highs, marking one of the asset's strongest performance months since ETF launches.

Technical indicators reinforced the uptrend. The Relative Strength Index held firmly in bullish territory, while MACD readings confirmed sustained buying pressure. Bollinger Band expansion signaled increasing volatility as ETH traded near $4,390—still below its 2021 all-time high of $4,890.

Asset managers and institutional funds accelerated ETH accumulation through regulated products, creating a structural barrier against selling pressure. Flagship ETFs from major providers led the charge as regulated access points for traditional capital.

Vitalik Buterin and Tom Lee Discuss Ethereum Treasuries: Growth Prospects and Systemic Risks

Ethereum treasury companies are emerging as a pivotal infrastructure for institutional ETH holdings, with nearly 3.7 million ETH ($16 billion) now under management. BitMine Immersion leads this nascent sector, attracting commentary from Ethereum co-founder Vitalik Buterin and Fundstrat's Tom Lee.

Buterin acknowledges the ecosystem benefits of diversified ETH custody solutions but cautions against excessive leverage during a Bankless podcast appearance. "Cascading liquidations could destabilize markets," he warned, while endorsing responsible operators as a stabilizing force. In a wry aside, Buterin quipped about the US government's unexpected role in Ethereum recovery efforts.

Tom Lee's Bitmine Immersion Technologies exemplifies institutional conviction, reflecting growing mainstream acceptance of ETH as a treasury asset. The trend signals Ethereum's maturation beyond speculative trading into corporate balance sheets.

ETH Price Prediction: Institutional Demand Fuels Rally Toward $7,500

Ethereum's price surge continues as institutional investors accumulate ETH at unprecedented levels, with holdings now representing 8% of total supply. Standard Chartered has revised its year-end target to $7,500, while projecting a long-term valuation of $25,000 by 2028.

The market momentum is driven by corporate treasury allocations and ETF inflows totaling $3 billion in August alone. BitMine Technologies' plan to raise $20 billion for ETH purchases underscores the growing institutional appetite. Technical indicators suggest consolidation above $4,600 could lead to a breakout toward $5,200.

Smaller Ethereum-based tokens are attracting retail interest as investors seek higher-growth opportunities. The ETH/BTC ETF holdings ratio has tripled in three months, signaling a shift in institutional preference toward Ethereum's ecosystem.

SharpLink Gaming Expands ETH Treasury to 728,804 Tokens Amid $103M Quarterly Loss

SharpLink Gaming has cemented its position as one of the largest corporate holders of Ether, disclosing holdings of 728,804 ETH with nearly all staked to generate rewards. The gaming firm reported 1,326 ETH in cumulative staking yields, though Q2 financials revealed a $103M loss against $0.7M revenue—a 30% decline year-over-year.

The company's ETH Concentration Metric surged 98% to 3.95, reflecting aggressive accumulation since adopting Ether as its primary treasury asset in June. A strategic partnership with Consensys provides proprietary access to Ethereum infrastructure, positioning SharpLink at the intersection of gaming and decentralized finance.

Could Ethereum Price Prediction of $6,000 Be Realized in August?

Ethereum's price has retreated sharply from its all-time high of $4,792, spooking retail investors amid shifting ETF flows and macroeconomic pressures. The U.S. Producer Price Index's 0.9% monthly jump—the steepest in three years—triggered a broad risk-off movement, dragging ETH down 8% to $4,422.

Yet institutional players tell a different story. BlackRock's spot ETF maintains steady inflows while whales accumulate aggressively on dips. This divergence paints a market torn between short-term caution and long-term conviction in Ethereum's fundamentals.

The $6,000 forecast hinges on whether macroeconomic headwinds subside and ETF demand accelerates. With the SEC's decision on ETH ETFs looming, August could deliver either validation or further consolidation.

ETH Price Retreats to $4,415 Despite Bullish Institutional Momentum - Key Levels to Watch

Ethereum's price dipped 4.89% to $4,415.77, marking a short-term pullback amid broader institutional accumulation. The decline follows yesterday's slip to $4,600, reflecting natural profit-taking after ETH's recent surge past $4,300.

Record-breaking $3 billion in Ethereum ETF inflows during August 2025 underscores growing institutional confidence, outpacing Bitcoin ETF performance. Standard Chartered's revised year-end target of $7,500—citing improved industry engagement and increased holdings—adds fundamental support to the bullish thesis.

Technical indicators suggest the retreat remains healthy, with Ethereum's RSI at 65.43 indicating room for consolidation within a strong uptrend. Market dynamics continue to reflect a tension between short-term profit-taking and structural accumulation by institutional players.

Will ETH Price Hit 5000?

The probability of ETH reaching $5,000 in the near term appears moderately high based on current technicals and fundamentals:

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Price Position | Above key MA support | MACD still negative |

| Institutional Flow | $130M+ accumulation | ETF outflows |

| Market Structure | Higher lows established | Bollinger upper band resistance |

"We're seeing about 60% probability for $5,000 in August," says BTCC's Michael. "The key watchpoint is whether the MACD can flip positive this week. If so, the path clears for testing all-time highs."